“Ajo” is the name of the savings culture popular among the Southwestern people of Nigeria. This is simply because the concept is one that is deep-rooted in trust, and the demography of people who participate in it are less tech-savvy people. This concept involved going to the vicinity of the people, like shops in market areas, to collect their daily contribution and give them their money whenever they requested it. Because of the trust that has been built, the people are able to access loans or advance payment for their business with little to no collateral involved. This is something that the banking system cannot provide them.

Muthsaal Investment Nigeria Limited now offers this service to over 5000 customers across 4 of the biggest markets in Ibadan, Nigeria - Dugbe, Bodija, Agbeni, and Ogunpa.

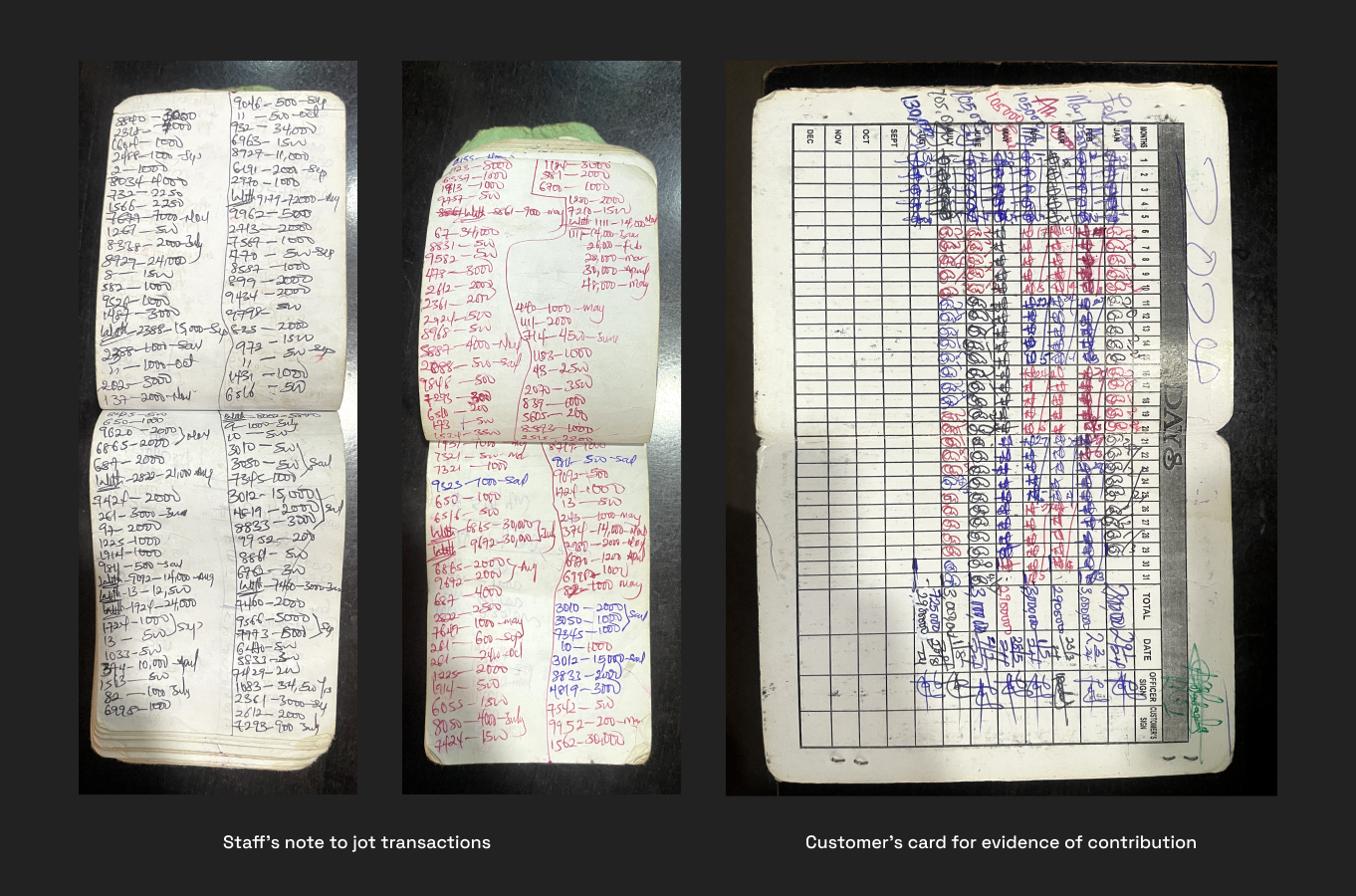

Between 2016 and 2017, I worked for the company as a Marketing Officer. My responsibility simply entailed going to the shops of about 200 customers within my service area to collect daily contributions from them, record their cards, jot my record in a paper and do my daily analysis to know the total money I collected and gave out to customers. This left a lot of paper trail that makes it hard to do analysis for the company.

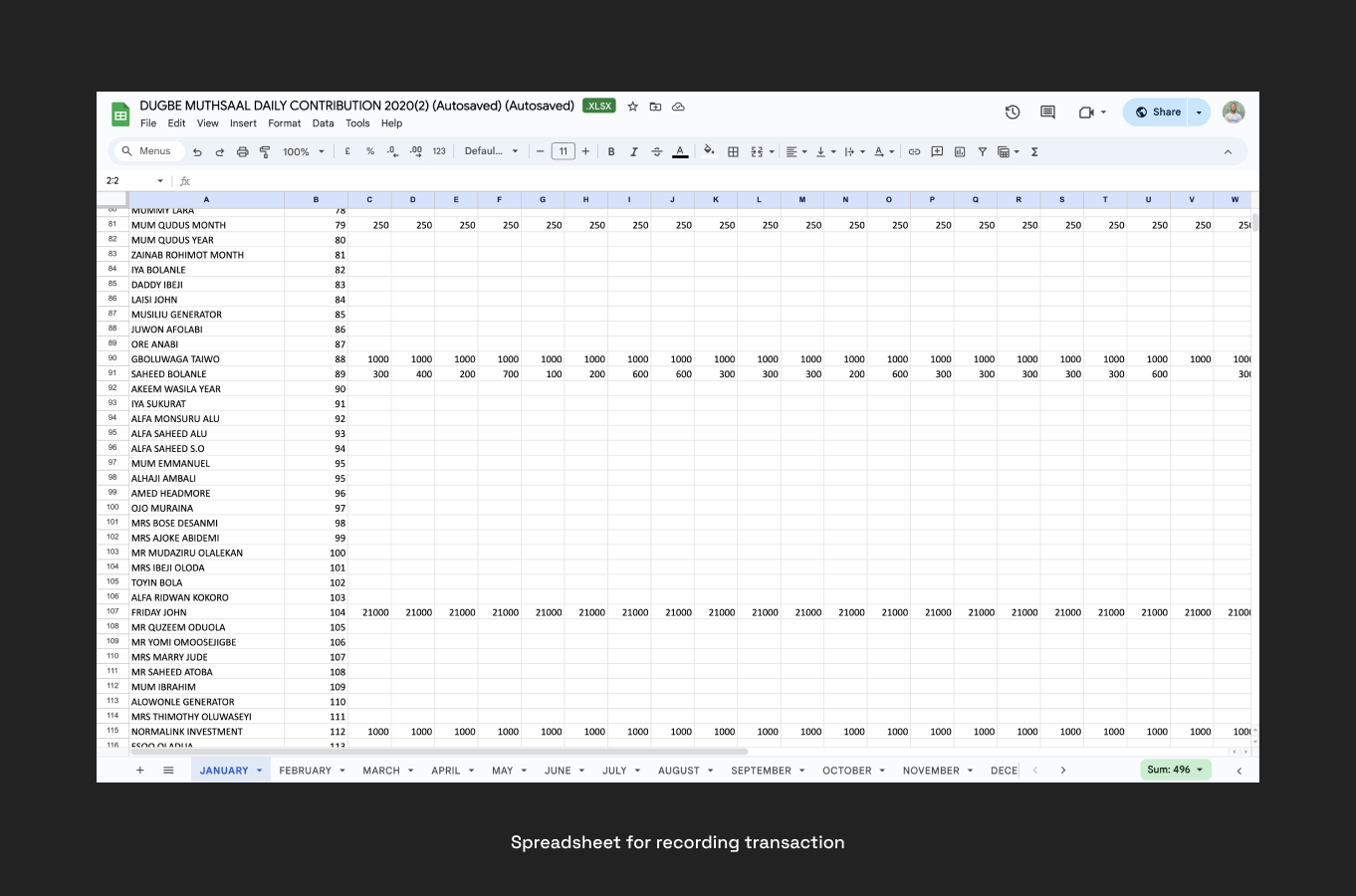

After leaving the company, in addition to the process above, the company incorporated the use of Microsoft Excel to log transaction data of customers. The setback in this was the transaction of a particular day is logged into Microsoft Excel by the Manager who is at the office, and it is always done the next day after the staff have submitted their transaction report for the previous day.

Another issue with this system is it does not give room for transparency because transaction records are not taken in real-time. It allows for easy manipulation of transaction records.

The primary consideration for designing Muthsaal 1.0 was the demography of their target customers, who are mid-literate and less tech-savvy people. This consideration eliminated the approach of making a solution that involved the customers to interact with the interface of the solution.

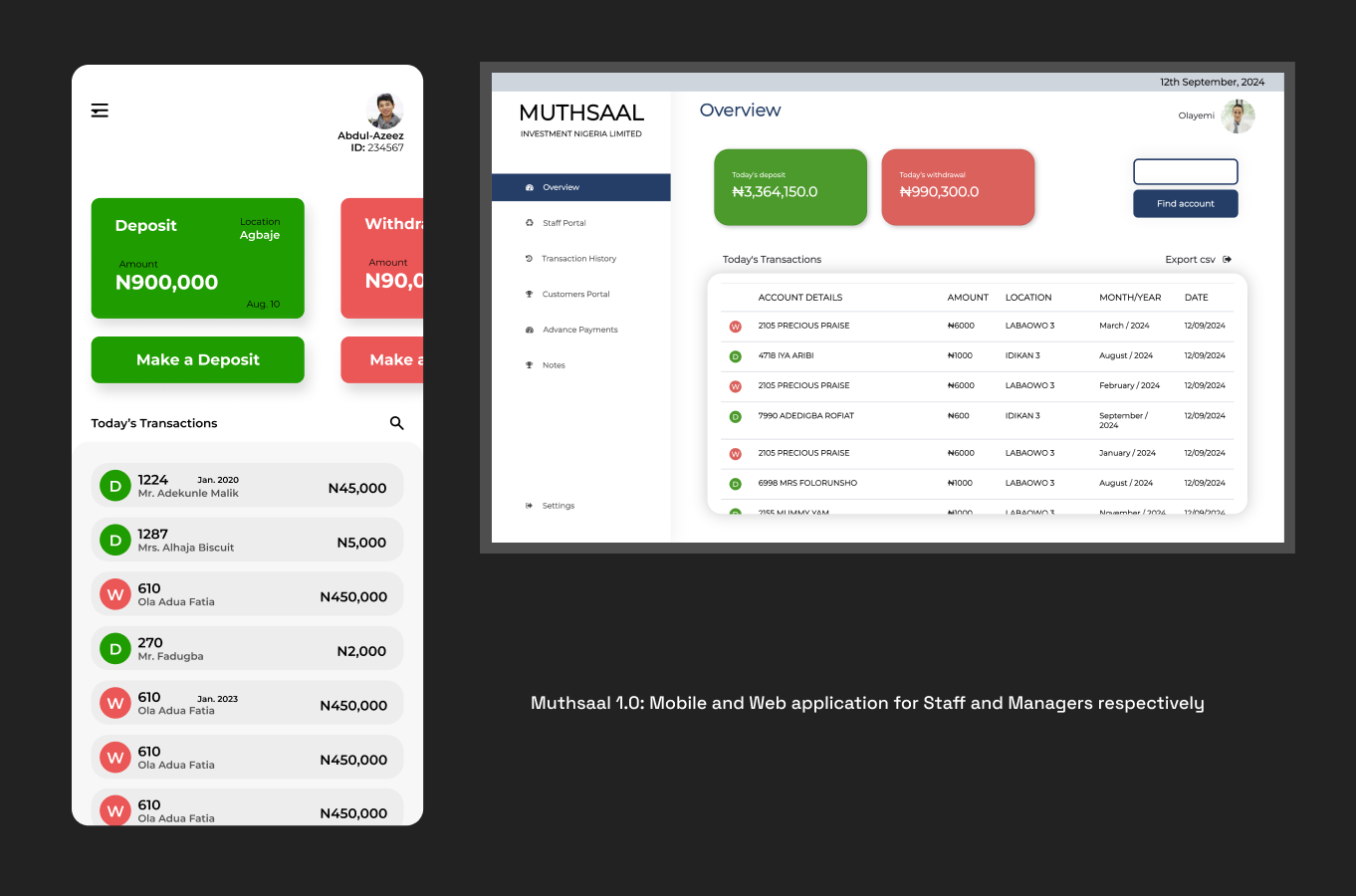

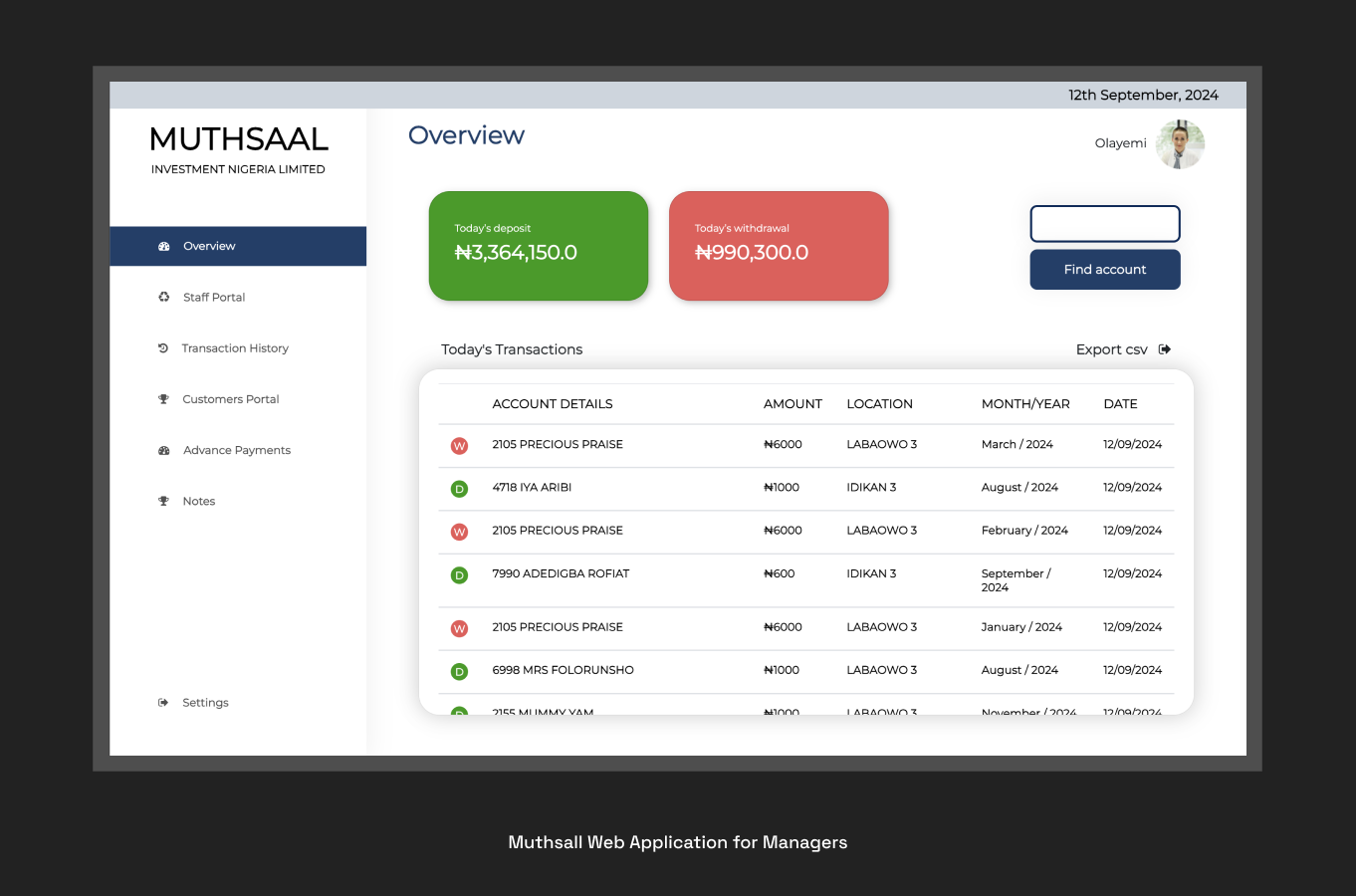

Instead, I approached this solution by designing a mobile application for the staff of the organisation to record daily transactions and a web application for the manager to perform deposit, withdrawal and track activity of staff.

An important aspect of the mobile application is being able to take records offline in case of slow internet connection and sync when they have stable access to the internet. While this is a very rare occurrence, integrating this helps to maintain swift record taking, as the major hindrance to the application is internet access.

Because record-taking happens in real-time, the manager cannot only track the activity of a staff but also that of the customers.

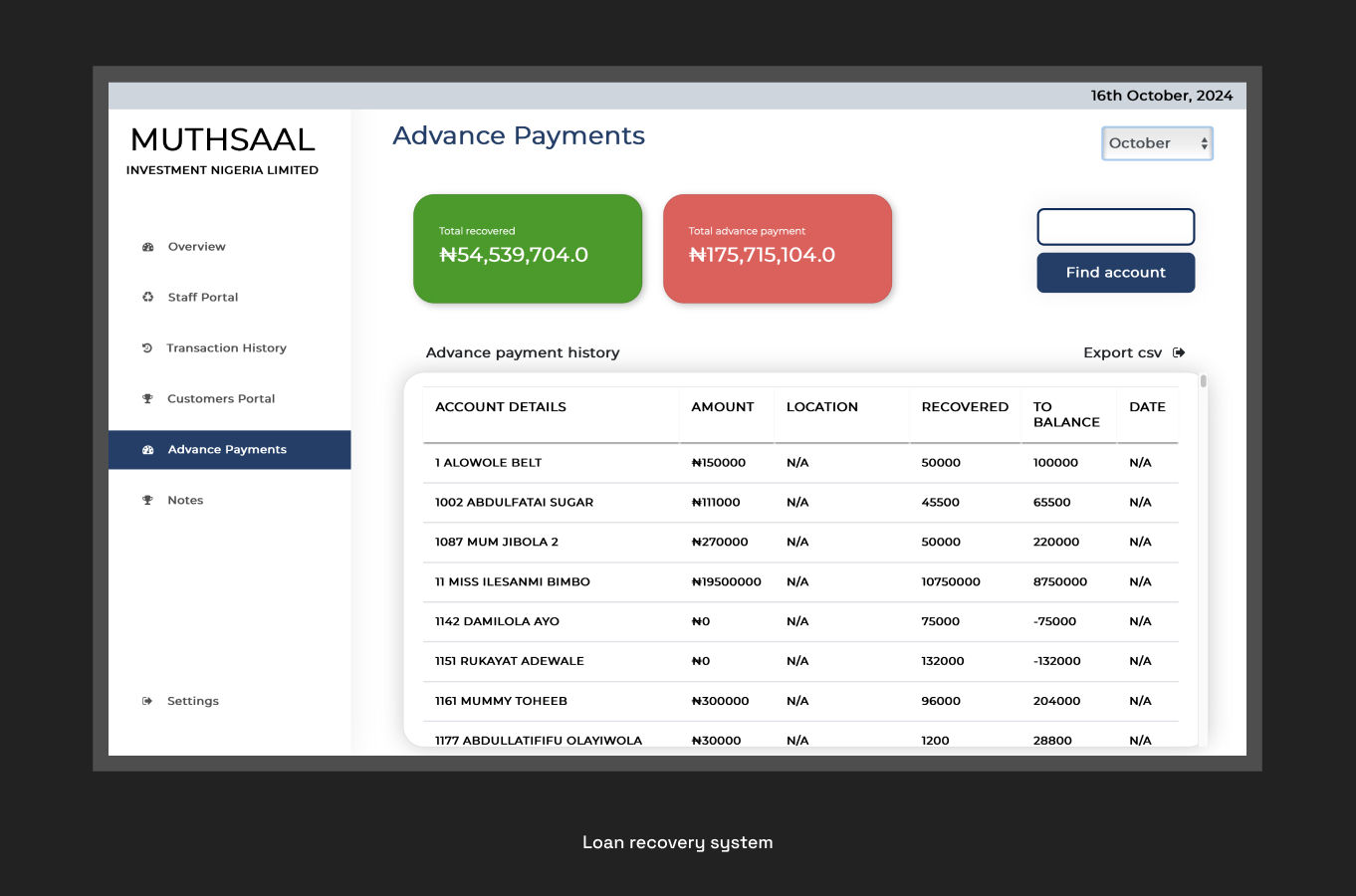

While Muthsaal 1.0 primarily solves the pain point of digitising the transaction record for the company, it also improved the loan monitory and recovery process by over 80%. For the loan monitory and recovery process, the manager can easily track if a staff has recorded the transaction of customers with heavy loan amounts, and if not, the manager can take swift actions in ensuring that the customers pay the corresponding daily amount they are expected to pay.

Muthsaal 1.0 has also made it very easy for the company to scale to other markets within Ibadan. Also, with the use of mobile applications by the staff in the market area, this has set the company aside from its competitors and opened them to a new demography of customers.

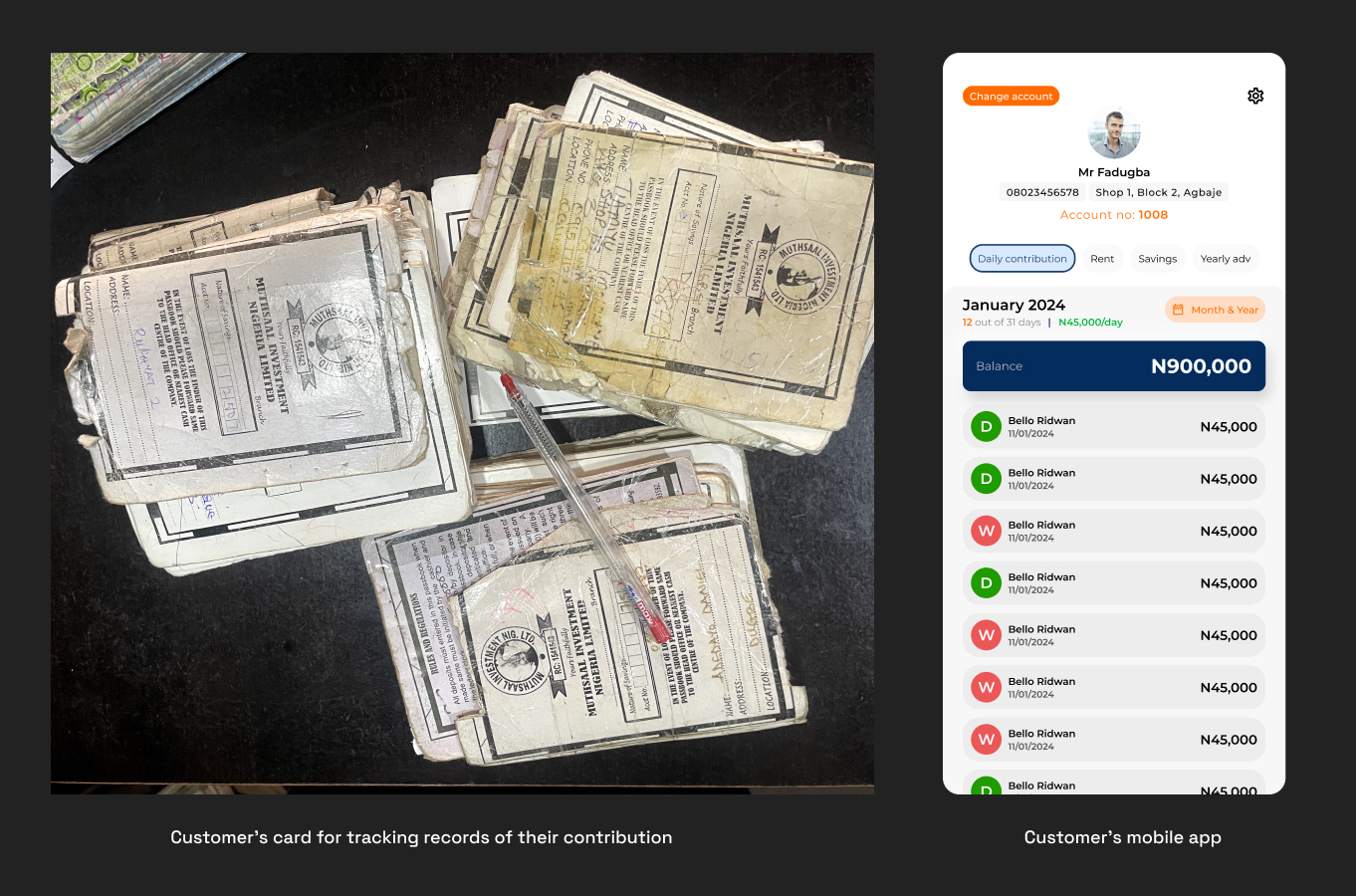

An important document in the operation of the company is the Customer's card. This customer’s card is what holds the customer copy of the transaction record by the staff of the organisation. In Muthsaal 1.0, there was no way of solving this because the customer’s demography was not welcoming of using a mobile application. This is largely because of the conception that their money is not safe in a mobile application.

However, since introducing Muthsaal 1.0 in 2021, the company has been able to orientate their customers on how the mobile application only keeps track of their record and that the staff will still physically appear in their shops to collect the money and record the transaction

Having reinforced this concept of trust with the customers, in 2024, Muthsaal 2.0 was introduced in a bid for the company to go fully digital, moving their customers away from the use of physical cards to the use of a mobile application in tracking their transaction records.

While the company has not gone fully digital, about 50% of the customer demographic now use the mobile application to track their transaction record. This is a significant step in their approach to go fully digital. Also, Muthsaal 2.0 solves a critical problem of trust-vacuum that comes with card misplacement on the part of the customers.